When entering data Tab or Return will take you to the next field. Dropdown box selections can be made by typing the first character and then using -> to select the correct item

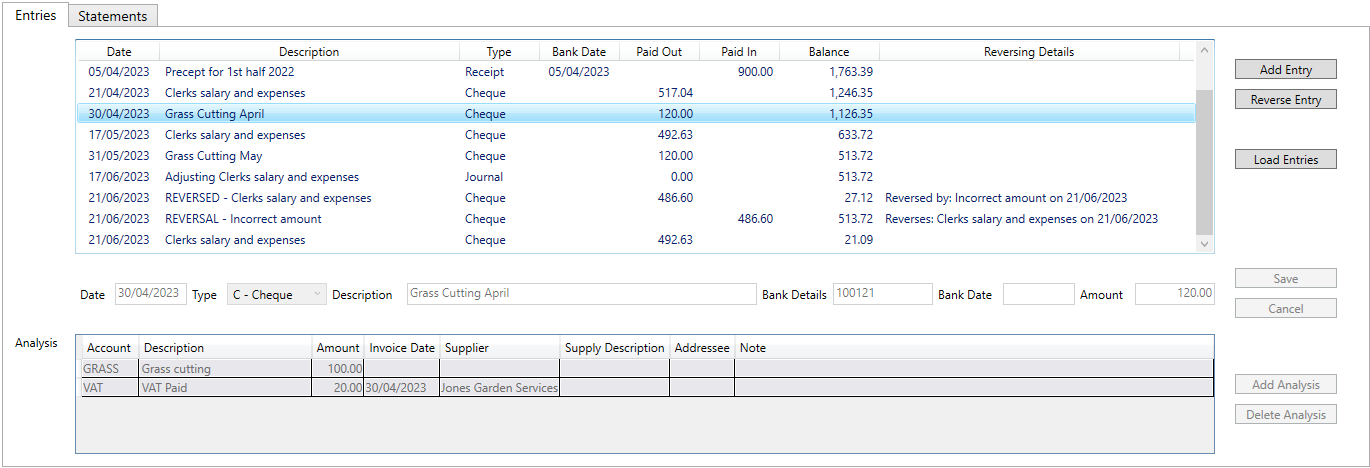

Adding Cashbook Entries

To add an Entry, click the Add Entry button, and enter the following details, and then click Save:

-

Date

The date of an entry must be withing the current Account Period. It can be in the future, which can be useful if you wish to enter cheques that are going to be signed at the next meeting.

-

Entry Type

This has to be one of the Entry Types associated with the current Cashbook. Can be selected by drop down, or simply entering the first character of the code.

-

Description

-

Bank Details

Is optional but intended for store information such as cheque number.

-

Bank Details

Is optional, and typically unknown when entering cheques, but can be useful when entering Direct Debits etc., from a statement.

-

Amount

Has to be > 0

Pressing Tab or Return will move down to the analysis.

-

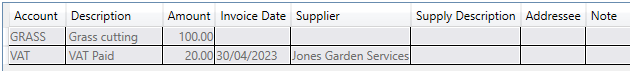

Analysis

You can add a new Analysis by clicking Add Analysis, or simply pressing Enter/Tab whilst in the Note field.

-

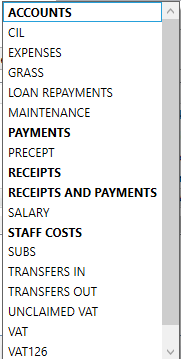

Account

Select account using the drop-down box, alternatively enter the first character of the account name and use ->.

The Accounts are presented as a flat list rather than a hierarchy. However, Accounts that have Sub-Accounts are shown in bold.

-

Use the VAT account to record the amount of VAT paid, not the VAT126 account, the latter is used when a claim is made.

Amount

This is the amount of the entry that is for the selected account.

-

Note

If you wish to record information that is relevant only to this particular analysis.

If the VAT account has been selected the following fields are enabled:

-

Invoice Date

This is the date on which the supply occurred.

-

Supplier

Select from the drop-down list of Suppliers. Suppliers and their VAT numbers can be entered on the Suppliers Tab.

-

Supply Description

It is only necessary to enter a description if it cannot be determined from the non-VAT analysis. I.E. If there is more than one non-VAT analysis, or the name of the account for that analysis does not match the description of the supply.

-

Addressee

If the Addressee is not the Council, enter the name of the addressee. When this is left blank the VAT126 report will you the Council as addressee

-

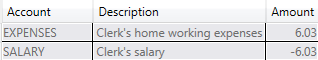

Journals

Journals are a special type of Entry. They don't represent money in or out, even though they show as an "Out" Entry Type, because their amount is fixed at zero. Their only use is to move amounts from one account to another, as in the following situations:

- Correcting analysis of entries that have been reconciled, otherwise it is better to use reversal.

- Setup VAT unclaimed prior to start of accounts.

Normally, you don't have to think about debits/credits, as the Entry Type determines what the analysis represents. However, when you are using Journals, you do have to think in those terms.

To debit an account have an analysis line with a +ve amount, to credit an account have an analysis line with a -ve amount. The amounts of all the analysis lines must sum to zero. Journals are the only Entry Types that allow -ve amounts in Analysis.

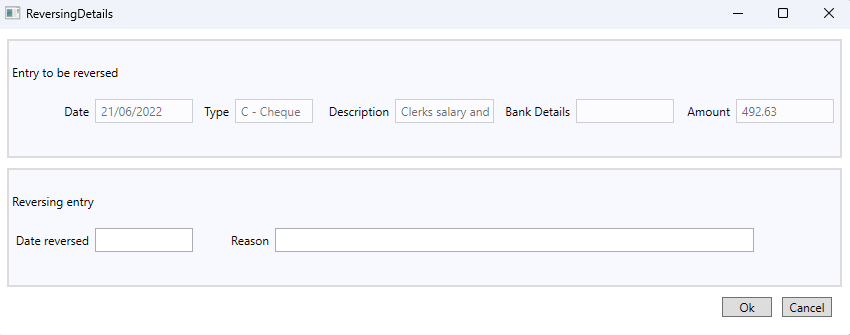

Reversing an Entry

To provide an audit trail, entries cannot be deleted or edited. However, entries can be reversed (effectively deleting), and re-entered (effectively an edit).

Reversals are also necessary for situations where a cheque has been raised but is never presented.

Transferring money between Cashbooks

Money is moved from one cashbook to the other by using the TRANSFER account. The payment in one Cashbook, and the receipt in the other, should both be analysed to the TRANSFER account. You may wish to setup extra Entry Types for this purpose, E.g.

| Code | Description | In/Out |

| TI | Transfer In | In |

| TO | Transfer Out | Out |