Recording VAT

When you enter a payment that has an element of VAT this is recorded in the analysis. A VAT analysis has four extra fields for the information required by VAT126:

-

Invoice Date

The date on which the supply occurred.

-

Supplier

This supplier's VAT No will be used.

-

Supply Description

If there is only one non-VAT analysis, the supply description is taken from the description of the account to which the analysis has been made. If the supply does not match the account description, or there is more than one non-VAT analysis, this is the description.

-

Addressee

When the Addressee was not the Council, the name of the addressee.

The VAT to be refunded is accumulated in the VAT account.

VAT Refund Claims

This tab lists the claims already made. Selecting a claim will show the VAT reclaimed on that Claim. The list at the bottom shows unclaimed VAT. If a payment is for a cashbook that has an associated Bank Account, it will only appear as unclaimed VAT if it is on a reconciled Bank Statement.

Making a claim

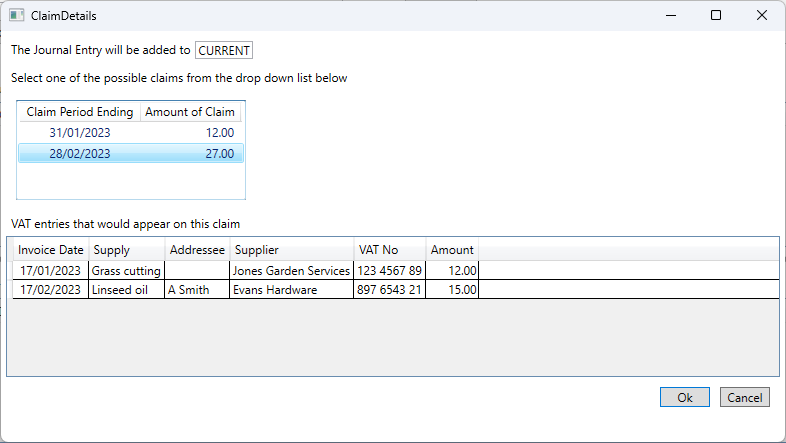

When you press the Make VAT Claim button, you will be presented with a list of possible claims based on the VAT126 requirements, which are a claim must be for a period ending on the last day on a calendar month, and, if the claim is for less than £100 it needs to cover a period of at least 12 months.

Select the claim you wish to make and press Ok

When a claim is made a Journal moves the claim amount from VAT to VAT126,