Example Journals

These examples are in the DEMO accounts.

Correcting Analysis

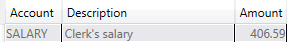

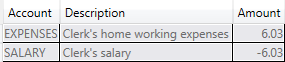

In this example a cheque was paid on 17/5/22 for £406.59. This was for the clerk's salary and expenses. However, it was all posted as SALARY. The Bank Statement on which the cheque appeared was reconciled. The error was discovered. As the analysis appears as a debit in SALARY, a journal was entered with line of -6.03 to reduce the amount posted to SALARY, and a line of 6.03 posted to EXPENSES.

Original analysis

Journal correcting analysis

Setup VAT unclaimed prior to start of accounts

-

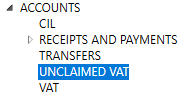

Create an account called UNCLAIMED VAT under ACCOUNTS

-

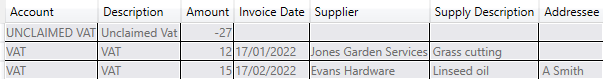

Add a Journal Entry that has one Analysis line for each VAT element unclaimed posted to the VAT account, and one line that has the total of all unclaimed VAT posted to UNCLAIMED VAT.

The Supply Description must be given in for each VAT element, as it is not possible to deduce it.